Debt Waiver Penalty Waiver Request Letter Sample

Your name your address your social security number mmm dd yyyy dear sir madam.

Debt waiver penalty waiver request letter sample. You did not previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty first time penalty abatement. A penalty abatement letter is a written request to the irs for penalty relief for one of the following reasons. For instance you may be given a citation a penalty fee or a new financial obligation. Here is a sample waiver letter for waiving personal rights.

If you feel that such is undeserved or if you feel that it would unfairly affect you then you can ask for it to be waived. However if you want to improve your chances of your request being accepted you should work with a tax professional. Dear sir or madam i am writing this letter respectfully requesting that you waiver my visa penalty due to past criminal record and reconsider my application. Waiver letter for payment start the letter off with a clear explanation regarding your request.

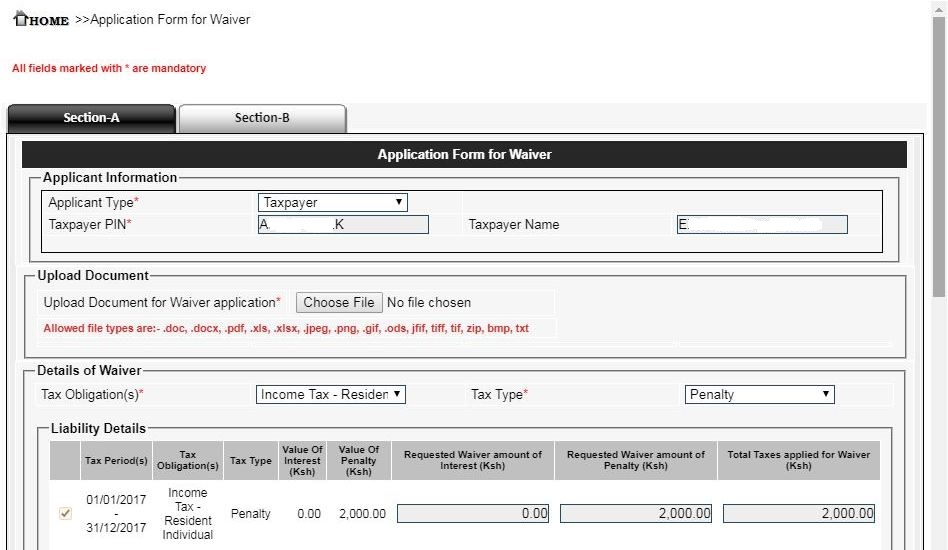

A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. A letter requesting waiver of personal rights should mention the dangers involved in signing the letter. To apply for a waiver submit a completed waiver remission of indebtedness application dd form 2789 pdf 354kb 5 19 2008 to your civilian payroll office. Request for penalty abatement under reasonable cause.

Sample irs penalty abatement request letter. If a waiver is granted in full or part you will not be required to pay the amount that was waived. Veteran benefits administration vba overpayments are governed by the department of veterans affairs under us code title 38 veterans benefits. Since it is a legal document it should also be in formal business style and sent by certified mail.

For instance explain that you re requesting certain fees or charges to be waived or to be released from a previous engagement. What reasonable cause is with examples examples of reasonable cause for late filing or late payment. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Veterans affairs employees should submit a written request for wavier of the debt and include a copy of the dfas debt letter to the va local payroll office.

You can use this template as a guide to help you write a letter. Irs reasonable cause letter sample. The following is a letter of waiver example requesting a penalty for a bounced check be waived. This should make the situation clear so the signee knows exactly what is involved.

If you are making a first time penalty abatement request for a year please see this page. Letter of waiver for immigration sample. Here is a sample letter to request irs penalty abatement. Internal revenue service use the address provided in your tax bill re.

The sender should request the signed waiver be returned by certified mail. When you request a waiver you are requesting that we terminate collection action on a debt.