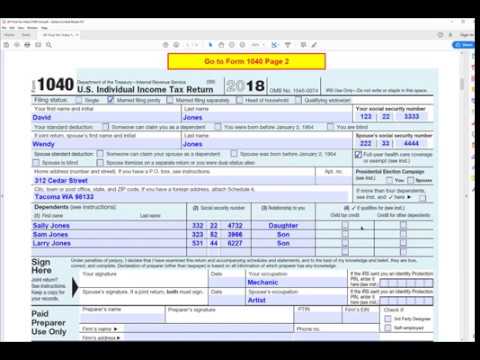

Married Filing 1040 Sample Form Filled Out 2018

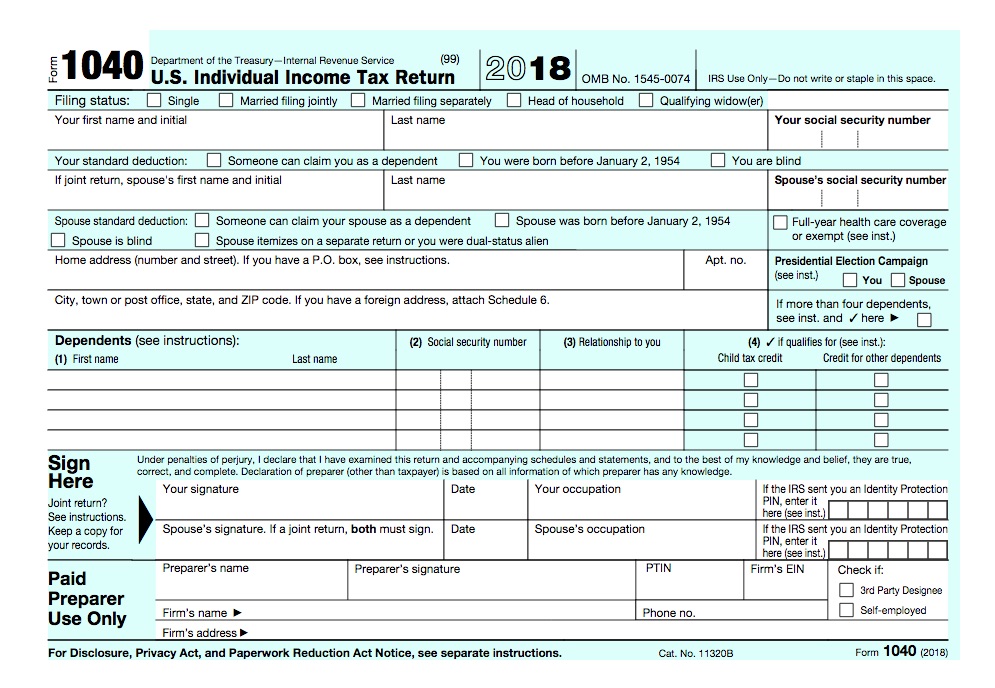

It also asks for your filing status.

Married filing 1040 sample form filled out 2018. Your social security number. Since brian and sarah have are filing jointly they are allowed a standard deduction of 24 000. If you claim such expenses check the 1040 instructions 2018 page 27 for details on how to calculate the total. Fill in your personal information.

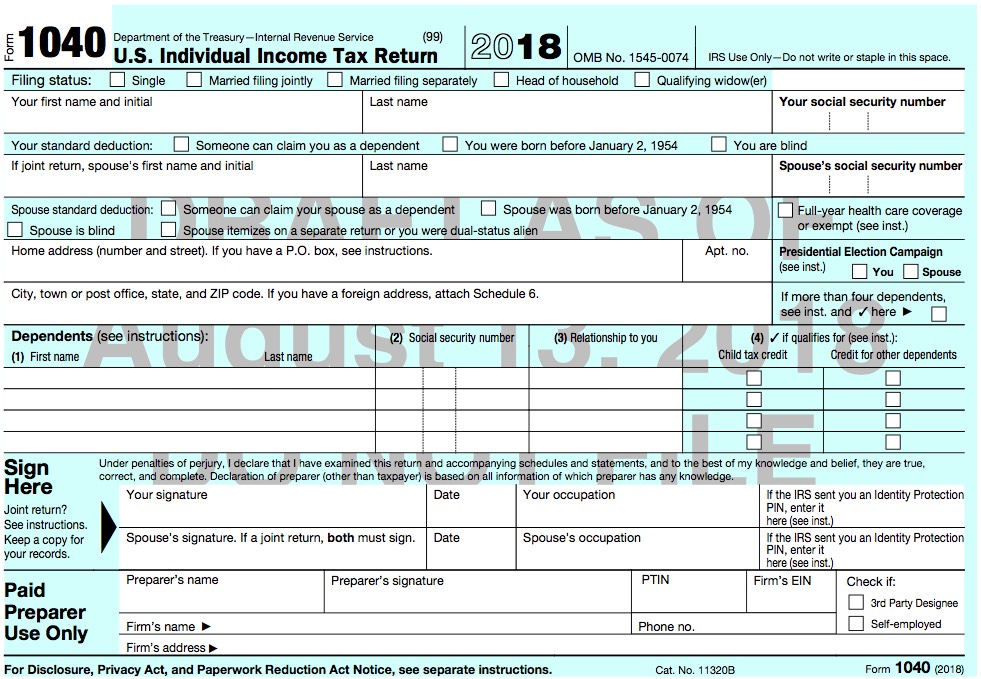

How to fill out irs form 1040. The irs indicated that the 1040 would automatically default to married filing jointly if it included two names and signatures or to the single status if it included just one. Single married filing jointly. Depending on your tax situation you may also need to attach other forms or schedules to your 1040.

Married filing separately mfs head of household hoh qualifying widow er qw. Click on any of the images to enlarge the top of the form simply asks for some basic information such as your name ssn address etc. Line 24 refers to reservists performing artists and government officials working on a fee basis. The basic form used for this is irs form 1040.

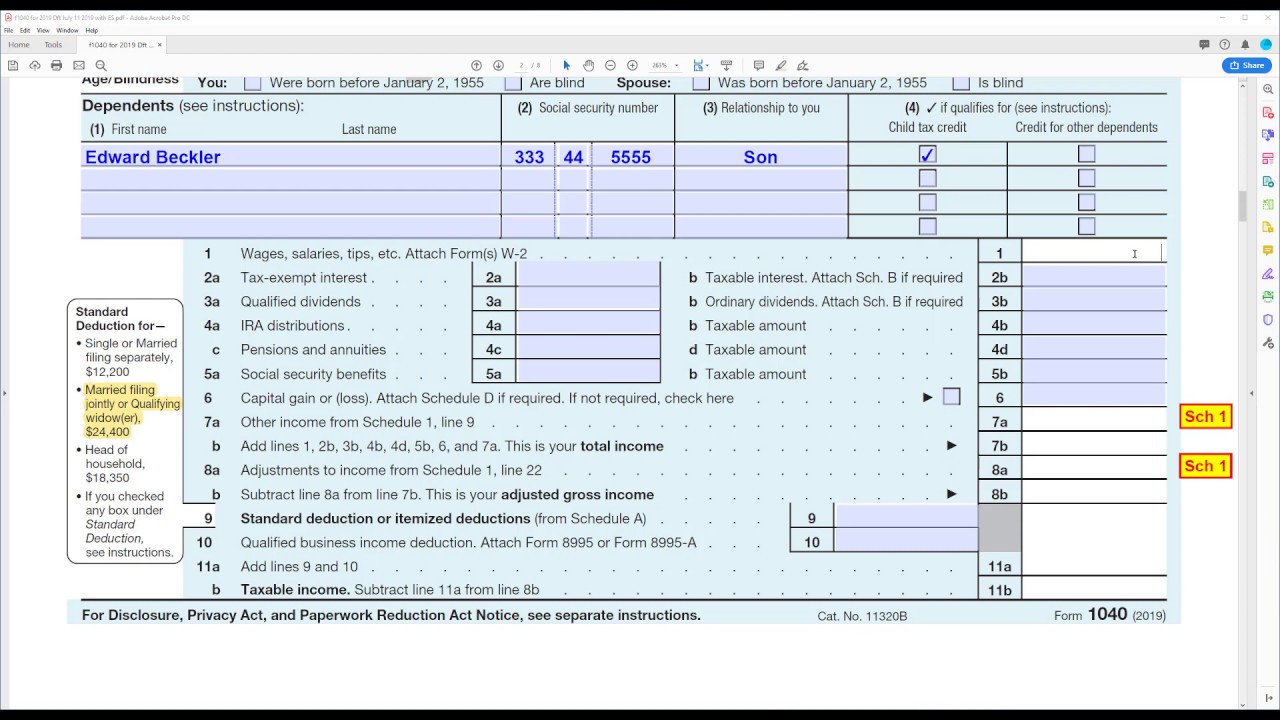

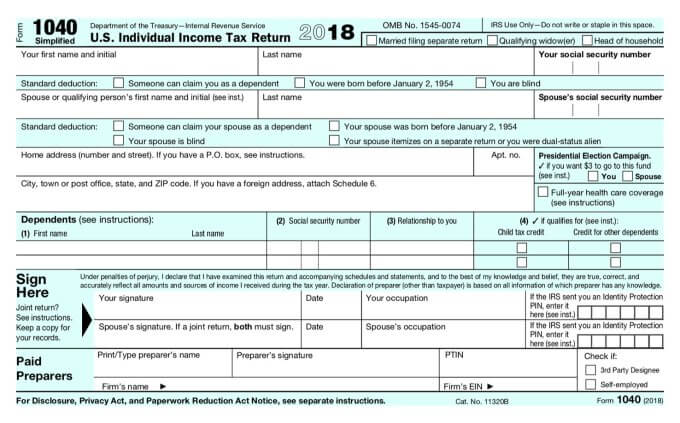

Most us citizens and resident aliens are required to file an individual tax return to the federal government every year. Form 1040 department of the treasury internal revenue service. There were multiple versions of the 1040 in the past but they were consolidated into one version starting in the 2018 tax year. Qualifying widow er your first name and initial.

This reduces their taxable income to 26 299 line 10 of form 1040. Line 23 refers to educator expenses. Unlike form 1040a and 1040ez both of. Irs use only do not write or staple in this space.

The same five filing statuses still exist they just weren t included on the original version of the 2018 form 1040. Just enter the required expenses and include form 2106 or 2106 ez. Check only one box. For the majority of people this is either single.

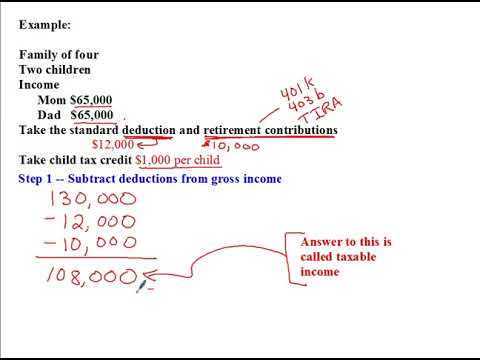

The first step in determining how much you are going to need to pay on your us expat taxes is determining your taxable income. Form 1040 is the base tax form that all filers must use when they file federal income taxes. Married filing separately head of household. Individual income tax return.

Form 1040 department of the treasury internal revenue service 99 u s. Individual income tax return.