Request Tax Penalty Waiver Letter Sample

I am filing a form 5329 to request a waiver of the penalty 50 of the missed rmd.

Request tax penalty waiver letter sample. The contents of a kra waiver letter are basically not that many. Below is a sample tax return penalty appeal letter. Address of property owner. For instance explain that you re requesting certain fees or charges to be waived or to be released from a previous engagement.

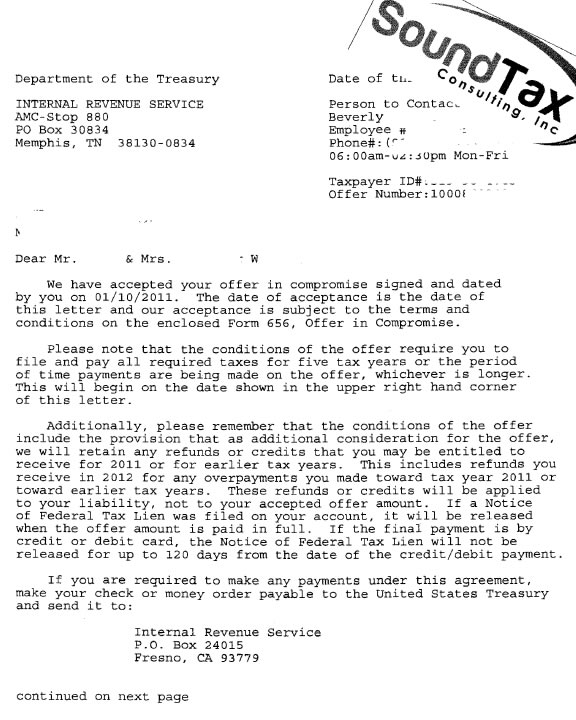

Sample irs penalty abatement request letter. I missed an rmd from my ira in 2018. However if you want to improve your chances of your request being accepted you should work with a tax professional. Waiver request letter samples waiver letter for bank charges.

Irs reasonable cause letter sample. My question is whether the payment should be made as part of the 5329 filing or. Here is a sample waiver letter for waiving personal rights. The provided information does not constitute financial tax or legal advice.

You need to know that the waiver letter is normally addressed. There is no specific format for writing the waiver letter. Request for penalty abatement under reasonable cause. It should be written in formal business letter style sent by certified mail with a return notice requested and sent as a cover letter with the proper application forms.

Since it is a legal document it should also be in formal business style and sent by certified mail. A penalty abatement letter is a written request to the irs for penalty relief for one of the following reasons. Here is a simplified irs letter template that you can use when writing to the irs. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you.

Internal revenue service use the address provided in your tax bill re. If you are making a first time penalty abatement request for a year please see this page. Name of property owner. Waiver letter for payment start the letter off with a clear explanation regarding your request.

You can use this template as a guide to help you write a letter. My plan is to file the 5329 prior to filing an extension in april 2019 anticipating that the irs will make a decision prior to the final 1040 filing. Sample 2 waiver for waiving personal rights. For instance you may be given a citation a penalty fee or a new financial obligation.

Writing kra waiver letter is quite simple. I also plan on paying the penalty upfront. You just need to write explaining the reasons why the penalties occurred and justify why you requesting for a waiver. The sender should request the signed waiver be returned by certified mail.

Your name your address your social security number mmm dd yyyy dear sir madam. If you feel that such is undeserved or if you feel that it would unfairly affect you then you can ask for it to be waived.